Are you trying to get a better handle on your business finances? You’re not alone — managing money can be one of the toughest parts of running a company. The good news is, you don’t have to do it all yourself. That’s where an accountant consultant comes in. They help you organize your finances, make smarter decisions, and bring structure to the chaos. With their support, your financial life becomes easier to manage — and you get to focus on growing your business without the constant money stress.

So, What Exactly Is an Accountant Consultant?

An accountant consultant is like your financial GPS. Instead of simply tracking where your money went, they guide you toward where it should go next.

They don’t just record your financial data; they interpret it, analyze it, and advise you on smarter ways to run your business. They translate all those intimidating spreadsheets into clear, actionable insights.

Think of it like this:

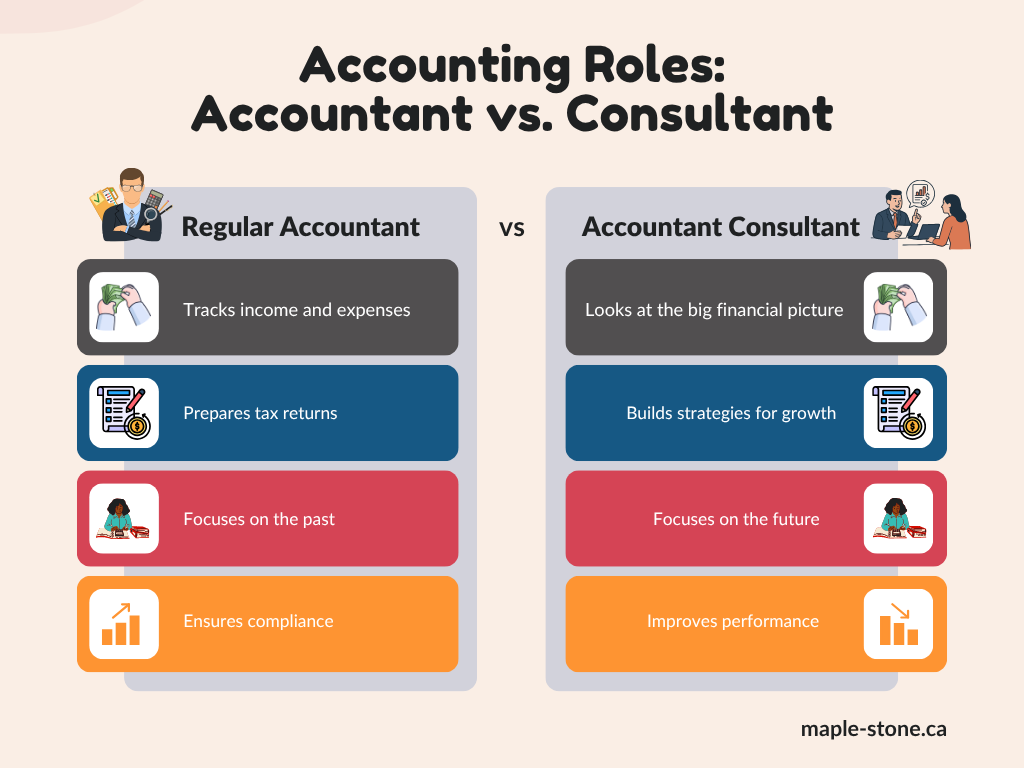

- Your regular accountant tells you what happened.

- Your consulting accountant helps you figure out what to do next.

In short, they turn numbers into decisions. And if you’ve ever wondered what is an accounting consultant, it’s someone who blends deep financial knowledge with practical business strategy.

The Real Difference: Accountant vs. Accountant Consultant

Now, an in-depth difference between an accountant and an accountant consultant will help you understand the concept. If a traditional accountant keeps your financial house in order, an accounting consultant helps you remodel it for success.

They ask deeper questions like:

- “Where are you losing profit?”

- “Which clients or products bring the most value?”

- “What’s holding back your growth?”

They see beyond the balance sheet, and that perspective changes everything.

Why Do Businesses Need a Consulting Accountant?

Running a business can sometimes feel like juggling flaming torches while riding a unicycle. You’ve got employees to manage, bills to pay, customers to serve, and a hundred things competing for your attention.

Your finances shouldn’t add to that chaos.

That’s where a consulting accounting expert steps in. They become your trusted partner — someone who understands both your numbers and your goals. Here’s how they help:

They Turn Confusion into Clarity

Ever looked at a financial report and thought, What does this even mean? You’re not alone. A consultant accountant breaks it down into simple, understandable insights. You’ll finally know where your money is going and why.

They Help You Plan

Instead of waiting until year-end to realize you overspent, your consultant helps you plan ahead. They’ll forecast trends, set budgets, and map out strategies that keep your finances healthy all year long.

They Save You Time and Stress

Taxes, payroll, compliance, budgeting — these things take time. A lot of it. By letting an expert in consulting services in accounting handle the heavy lifting, you free up hours every week to focus on what you actually love doing: growing your business.

They Help You Avoid Costly Mistakes

Whether it’s missing deductions or misunderstanding tax rules, financial errors can get expensive.

Your consultant accounting partner keeps you compliant and efficient, ensuring you don’t lose money (or sleep) over preventable issues.

They Keep Growth Sustainable

Many businesses grow fast and then crumble because their finances can’t keep up. An accounting consultant company helps you scale intelligently by managing cash flow, planning investments, and forecasting future needs.

What Accountant Consultants Actually Do

Credit: biola.edu

Here’s what these financial pros handle day-to-day:

- Strategic Planning: Setting goals and designing roadmaps to hit them.

- Budgeting and Forecasting: Predicting what’s coming next so you can prepare.

- Cash Flow Management: Keeping your inflows and outflows balanced.

- Tax Planning: Minimizing liabilities legally and smartly.

- Performance Analysis: Identifying which parts of your business make (or lose) money.

- Financial Risk Assessment: Finding weak spots before they become big problems.

- Accounting Advice: Offering actionable insights to guide business decisions.

They’re not just accountants; they’re decision-making allies offering reliable accounting advice tailored to your business.

Why Small Businesses Need Them the Most

You might be thinking, “That sounds great, but I run a small business, do I really need one?”

Short answer: yes, probably more than big companies do.

Here’s why: small businesses often run on tight budgets, smaller teams, and limited time. Every decision: hiring, pricing, marketing, affects your bottom line. Having an expert who understands how those decisions play out financially can make a huge difference.

A good accounting system consultant can help you:

- Build a realistic budget that supports your goals.

- Manage unpredictable cash flow.

- Identify areas where you can cut costs without cutting corners.

- Use modern consulting accounting software to save time and prevent errors.

They’re not just bookkeepers — they’re like co-pilots helping you steer through financial turbulence.

Benefits of Having an Accounting Consultant

Let’s go beyond the obvious. Here’s what business owners often don’t expect but love about working with a consultant:

They Simplify the Complicated

You don’t need to be a financial pro. A great consultant accountant speaks human, not “spreadsheet.”

Fresh Perspective

When you’re deep in your business, it’s easy to miss blind spots. Consultants see your finances objectively and offer outside insight.

They Guide You Through Change

Expanding, merging, or facing tough times? They help you adjust your strategies without losing control of your money.

They Leverage Technology

Modern consultants use AI-driven tools that automate reports, detect trends, and save time; that’s one major benefit of consulting accounting today.

They’re Always a Sounding Board

Need to make a big decision? Your consultant becomes the calm voice that helps you weigh your options with facts, not guesswork.

When Should You Hire One?

Here are some moments that signal it’s time to bring a consultant accountant on board:

- You’ve started growing faster than expected.

- You’re not sure why profits don’t match your sales.

- Tax season feels like a nightmare every year.

- You want to expand or invest but need expert advice.

- You’re tired of worrying about “what if I mess something up?”

If any of those sound familiar, don’t wait; call a trusted accounting consultant and let them handle the stress.

What to Look for in a Good Accountant Consultant

Credit: getcanopy.com

Not all consultants are created equal. Here’s what sets the best apart:

- Proven Experience – Look for someone who understands your industry.

- Strong Communication – They should make complex ideas simple.

- Analytical Mindset – You want someone who loves solving financial puzzles.

- Tech Skills – Bonus points if they use modern business accounting tools or automation.

- Transparency – They should be upfront about their accounting consultant fee, process, and results.

When you find the right fit, you’ll wonder how you ever managed without one.

The Role of AI and Modern Tools

The future of accounting is already here, and it’s smarter than ever.

Today’s accounting consultants use AI in accounting and automation to handle repetitive tasks like data entry, reconciliation, and reporting. That leaves them more time to focus on strategy, planning, and analysis.

The benefits of consulting services in accounting and AI tools are huge:

- Real-time insights

- Reduced human error

- Faster reporting

- Predictive analytics

It’s not about replacing humans, it’s about empowering them to serve you better.

Why Every Business Needs One

Whether you’re a solo entrepreneur, a startup, or a growing company, having a consultant accounting partner changes how you handle your finances.

When you understand your numbers, you stop reacting and start strategizing.

A great consultant helps you:

- Build a roadmap for financial success

- Make smarter, data-backed decisions

- Save time, money, and stress

- Avoid costly financial missteps

- Grow sustainably with confidence

They help your business move from “doing okay” to “doing great.”

The Bottom Line

An accountant consultant isn’t just another expense; they’re an investment in your business’s future. They bring clarity where there’s confusion, confidence where there’s doubt, and strategy where there was just guesswork.

Frequently Asked Questions

Need some information regarding an accountant consultant? Here are the answers you might be looking for.

What does an accountant consultant actually do?

They analyze financial data, offer accounting advice, and help you make smart money decisions that improve profitability and growth.

Is hiring a consulting accountant worth it for small businesses?

Absolutely. They save you time, reduce costly mistakes, and help you plan your finances strategically, even on a small budget.

How is a consultant accountant different from a regular accountant?

A regular accountant handles compliance and records, while a consulting accountant focuses on financial strategy, business insights, and growth planning.

How much does an accounting consultant cost?

The accounting consultant fee depends on your needs; smaller businesses might hire for specific projects, while larger companies often retain ongoing consulting support.

Can AI replace accounting consultants?

No. AI supports consultant accounting work, but human consultants bring judgment, creativity, and strategy, things no machine can replace.